The Economics Behind Magnify Cash: How 17.25% Fees Power 20% Annual Yields

In the world of DeFi, yields are everywhere — but sustainability is rare. At Magnify Cash, our mission isn’t just to generate returns. It’s to build a financial system where yields are real, transparent, and directly tied to economic activity that improves lives.

Let’s break down exactly how our 17.25% loan fee model powers 8% to 20% APY for stakers, how capital flows through the system, and why this model scales safely with user growth.

How It Works: The Core Revenue Engine

At the center of Magnify's ecosystem is a simple but powerful concept: microloans backed by real user identity and repaid in stablecoins. Here’s how the economics work:

Each Loan:

- Average principal: $30

- Fee per loan: $5.18 (17.25%)

- Loan term: 30 days

This means every dollar lent earns 17.25 cents per month. Multiply that across thousands of loans, and you get a system that produces high-frequency, stable yield.

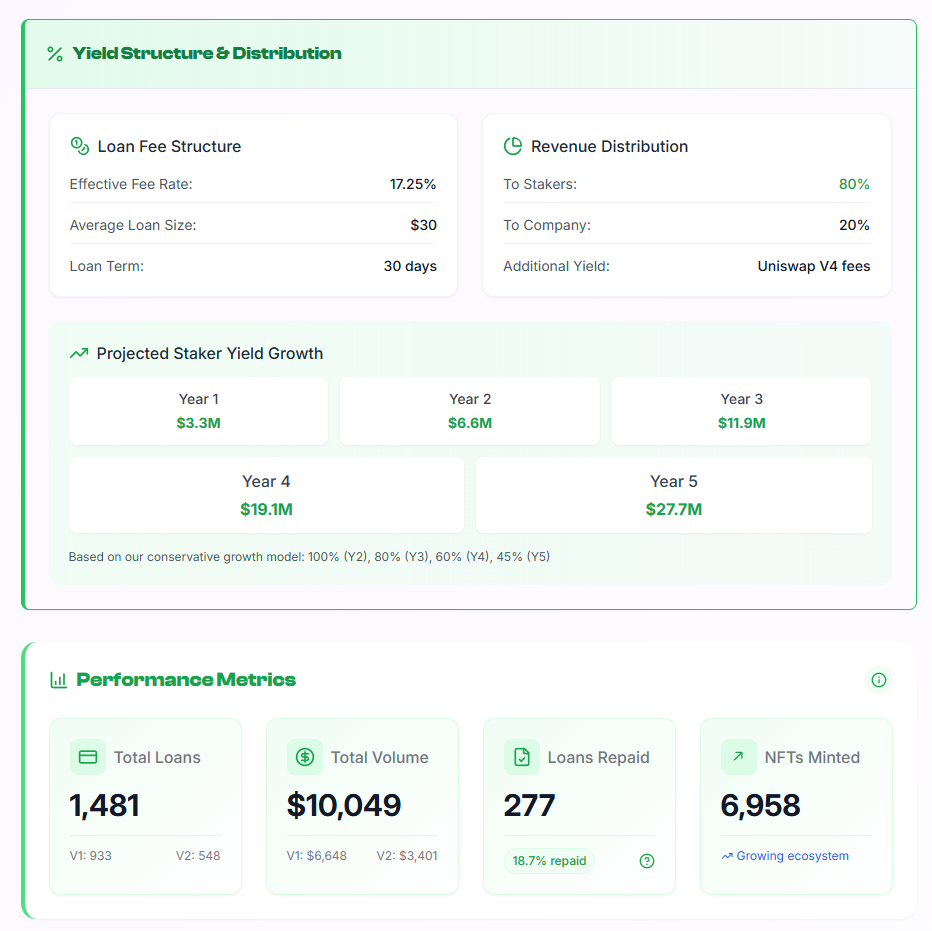

Where That Fee Goes

We split revenue from every loan 80/20 between stakers and the protocol treasury.

| Recipient | Share | Role |

|---|---|---|

| Stakers | 80% | Capital providers + reward earners |

| Company | 20% | Platform development + growth |

So if a $30 loan generates a $5.18 fee:

- $4.14 goes to stakers

- $1.04 goes to Magnify

This ensures that stakers — the lifeblood of the liquidity pool — benefit directly from the platform's success.

Yield Breakdown: Real Math, Not Magic

Let’s say you stake $1,000 into the Magnify pool.

At 17.25% fees on each 30-day loan, and assuming full loan rotation every month:

- Your $1,000 funds about 33 loans of $30 each

- Each loan generates $5.18 in fees

- That’s $170+ in total fees per month

- You receive 80% of that → $136 per month

- That’s over $1,600 per year, or 16%+ APY

Add in additional yield from Uniswap v4 hooks (more on that next), and your total yield climbs to the 8% to 20% APY range, depending on loan volume and platform activity.

Uniswap v4: Bonus Yield Through Liquidity

We’re not just using capital for lending. As part of Magnify V4, idle liquidity will be routed through Uniswap v4’s programmable liquidity hooks, earning passive fees between loan cycles.

This turns unused capital into an extra revenue stream, reducing downtime for your capital and improving yield consistency.

It also adds a layer of composability, opening up possibilities like:

- Cross-pool routing

- Dynamic liquidity allocation

- Staking with automated LP management

Growth Drives Yield

The best part? This model scales naturally as we grow:

Current Numbers (V2):

- 1,481 loans issued

- $10,049 loaned

- 18.7% repayment rate so far (still active loans)

Projected Growth:

- V3 (April 2025): AI reduces default rate to 5–8%

- V4 (May/June 2025): Global rollout with 100,000s of monthly loans

- Year 1 Revenue to Stakers: $3.3M

- Year 5 Revenue to Stakers: $27.7M (based on projected 2M loans/year)

Why This Model Works

- High volume + short cycles = fast compounding

- Verified users via World ID = low fraud, high repayment

- No gas fees = more accessible for borrowers

- Fair fee split = aligned incentives across all participants

Most importantly, this yield is rooted in productive activity, not speculation. Every dollar earned comes from solving real problems for real users.

A Quick Visual Recap

$30 Loan Example

- Borrower repays $35.18

- $4.14 → stakers

- $1.04 → company

- Loan term: 30 days

- Staker APY range: 8% to 20%

Ready to Stake or Invest?

The $1.2M seed round is live, and the opportunity is open for those who want to back the future of sustainable, scalable DeFi lending.

- Stake now to earn from live loan activity

- Invest in the protocol to support growth and infrastructure

- Track live metrics on Dune Analytics