💸 Lender Guide: How to Earn with Magnify Cash V3

Start earning real yield with Magnify Cash V3. Lend USDC, fund verified borrowers, and unlock bonus rewards in $WLD and $MAG. Gasless lending on World Chain is here.

Magnify Cash V3 introduces a new and powerful way for liquidity providers to earn real yield by fueling verified borrowers around the world.

This guide explains exactly how lending works, how liquidity pools are structured, and how you can maximize your rewards while helping grow a global credit network.

🌟 Why Lend on Magnify Cash?

- Earn 8% to 20% APY based on real economic activity, not token emissions

- Support verified borrowers uniquely identified through World ID

- Enjoy a gasless experience if lending inside the World App

- Choose your risk profile with three specialized USDC vaults

- Unlock bonus rewards as an early liquidity provider

🎁 Special Rewards for Early LPs

To celebrate the launch of Magnify Cash V3, we are introducing a limited-time incentive program for early liquidity providers.

Early LPs will be eligible to earn additional rewards in:

- $WLD tokens (Worldcoin)

- $MAG tokens (Magnify's native token, already live and coming soon to World Chain)

If you supply liquidity during the Warm-Up phase or early Active phase of any pool, you will qualify for these extra reward distributions on top of your regular USDC yield.

Distribution details for $MAG on World Chain will be announced soon.

Early liquidity means bigger rewards. Stake early to maximize your upside.

🚀 How Lending Works

Magnify Cash uses three separate ERC-4626 liquidity vaults. When you lend your USDC into a vault, your capital is used to fund short-term microloans to verified users.

You earn a share of the 17.25% loan fees collected each month. More lending volume means more yield, and your principal remains inside the vault to keep compounding.

| Vault | Borrower Profile | Risk Level | Expected Yield |

|---|---|---|---|

| HULP | High-volume, high-reputation borrowers | Low | Stable and predictable returns |

| FCLP | First-time borrowers or frontier markets | Medium | Moderate growth potential |

| DFLP | Borrowers rebuilding after default | High | High potential with higher risk |

🛠 Full Lending Guide: Step-by-Step

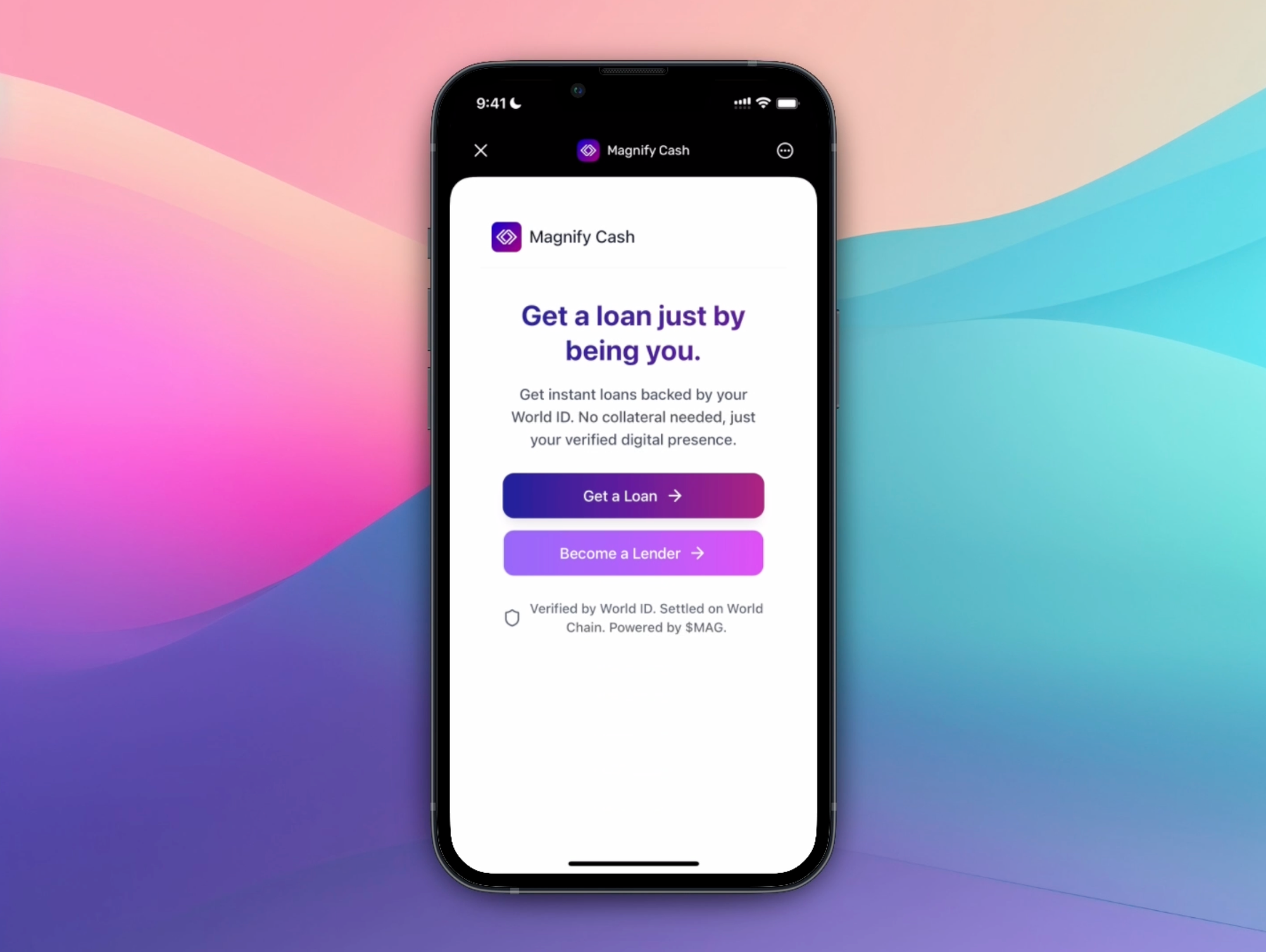

Step 1: Open the World App

👉 You must have the World App installed.

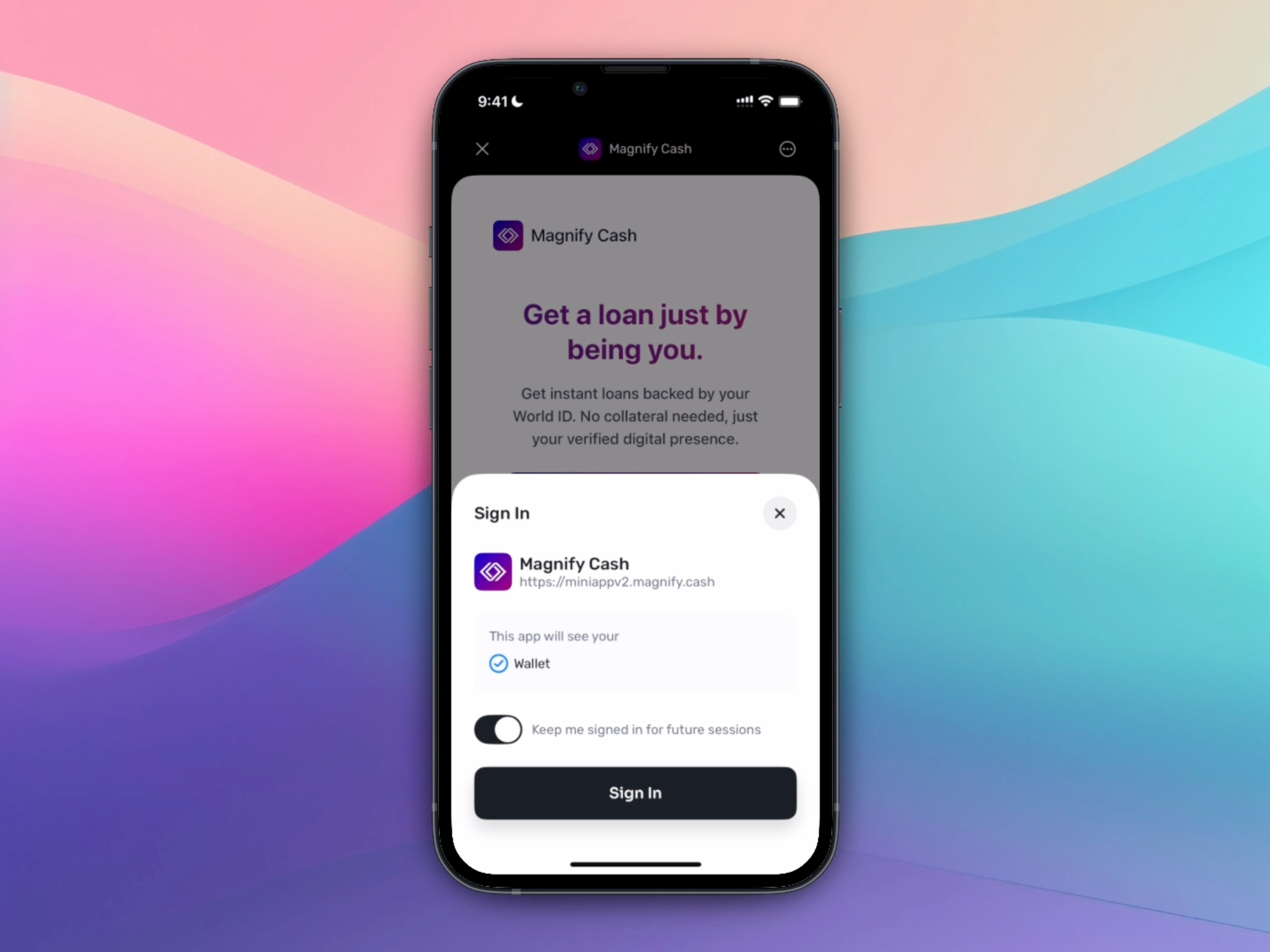

Step 2: Navigate to Magnify Cash

👉 Find the Magnify Cash mini-app and open it.

Step 3: Select "Become a Lender"

👉 Tap on Become a Lender to start the flow.

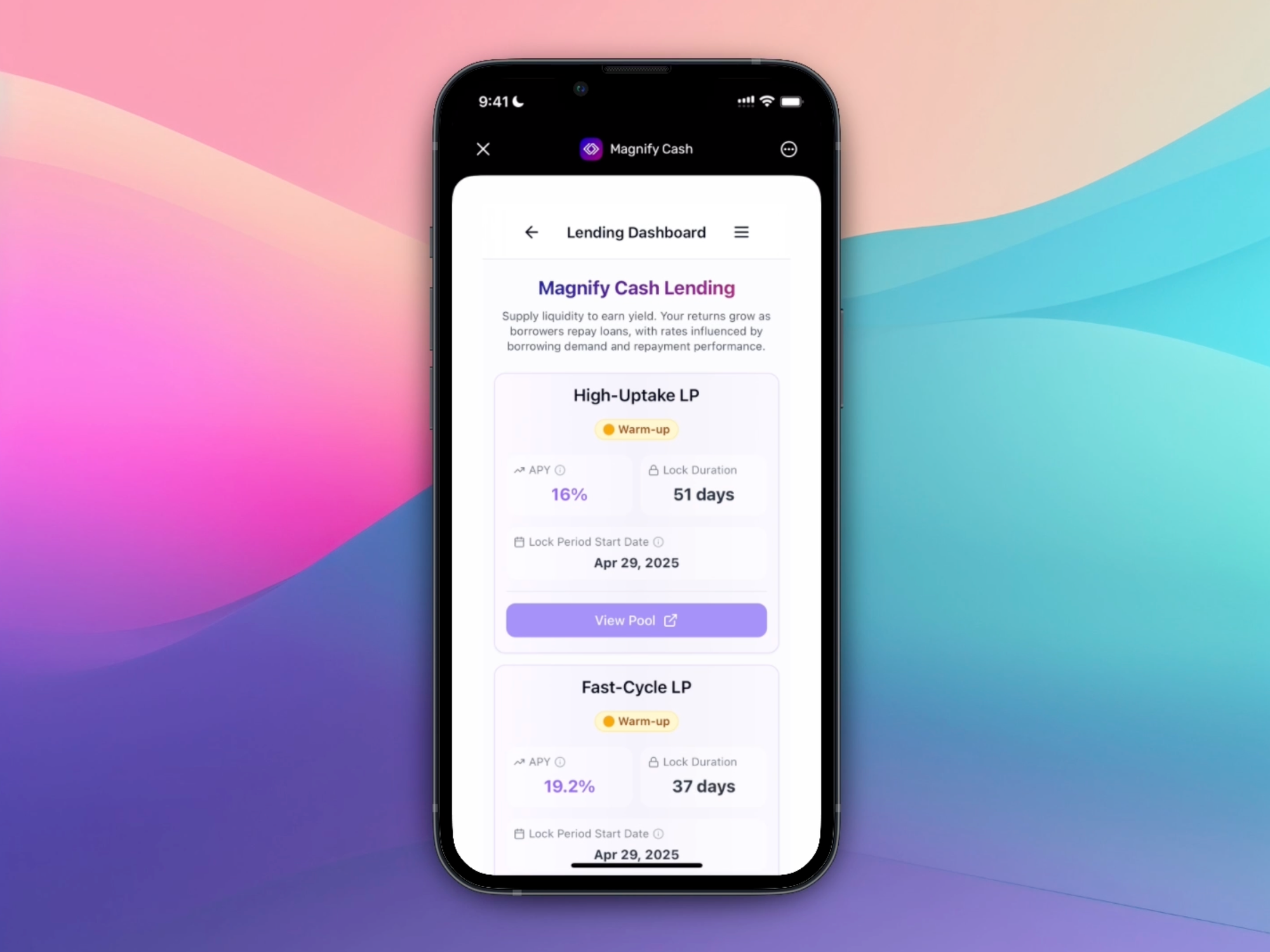

Step 4: Choose Your Vault

👉 Select the vault (HULP, FCLP, DFLP) that matches your risk preference.

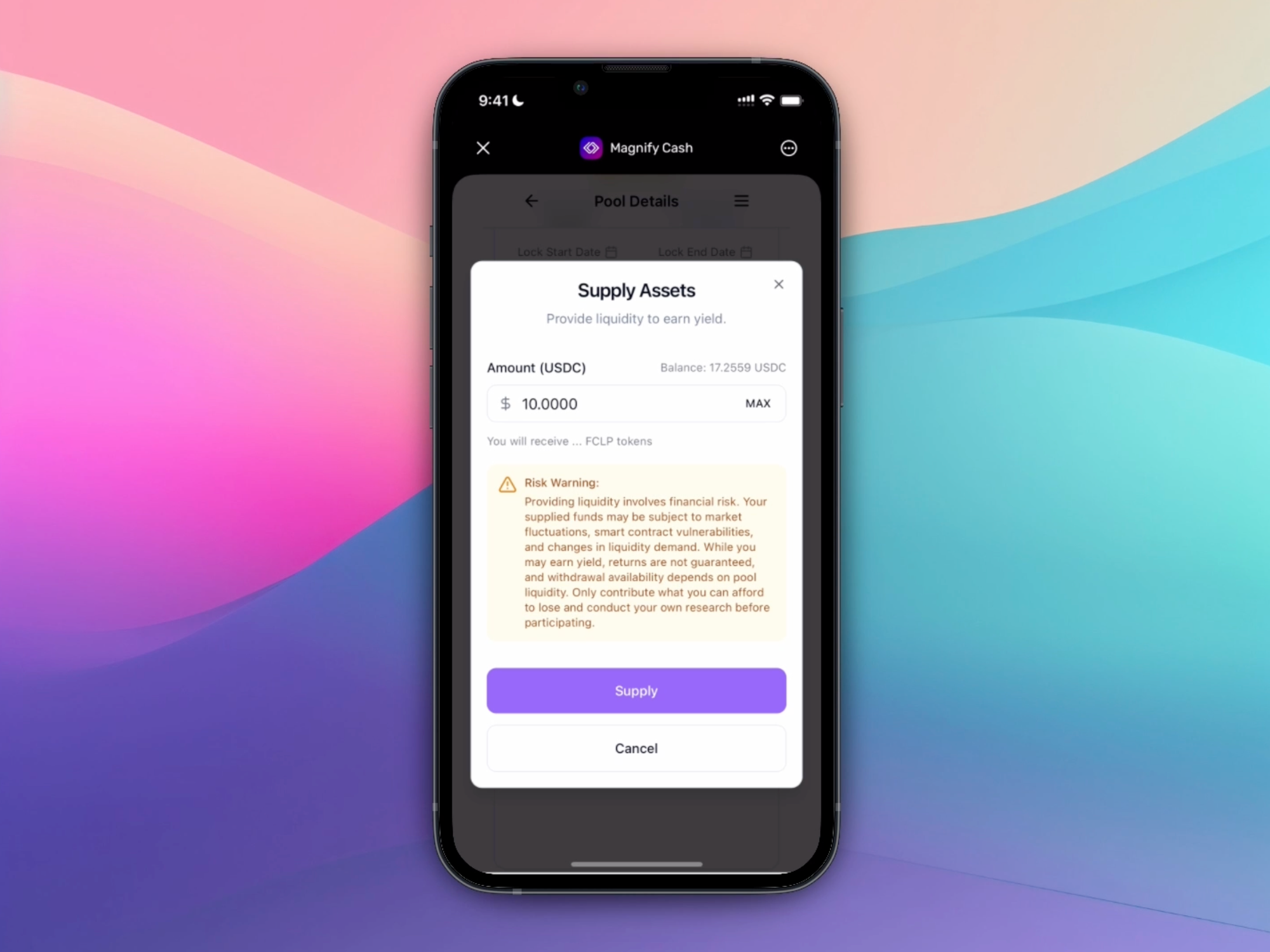

Step 5: Enter Your Deposit Amount

👉 Input the amount of USDC you want to lend.

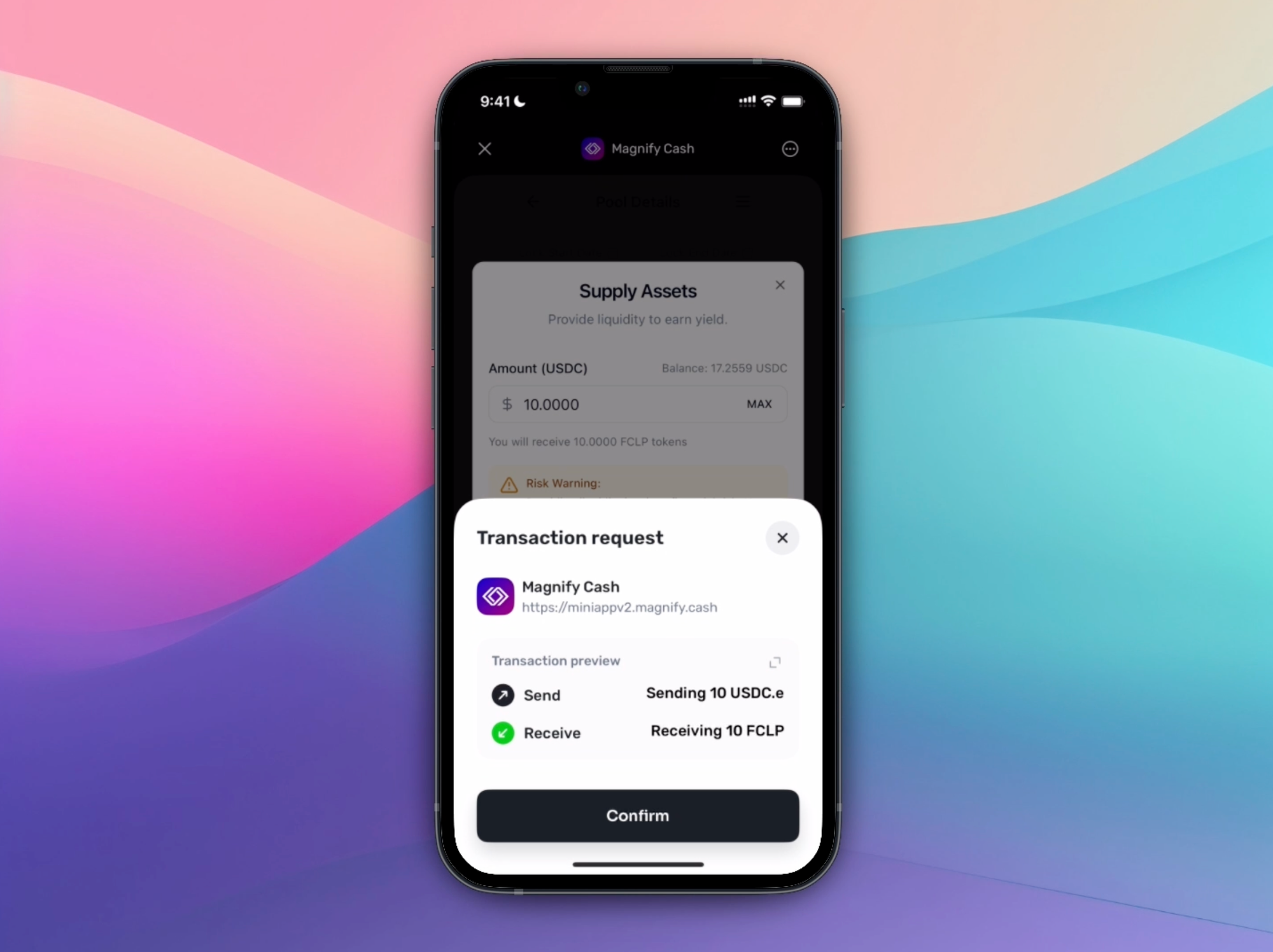

Step 6: Confirm Your Deposit

👉 Review the transaction and confirm it.

Important:Lending inside the World App mini-app incurs no gas fees.Lending via MetaMask or browser incurs small gas fees (although minimal).

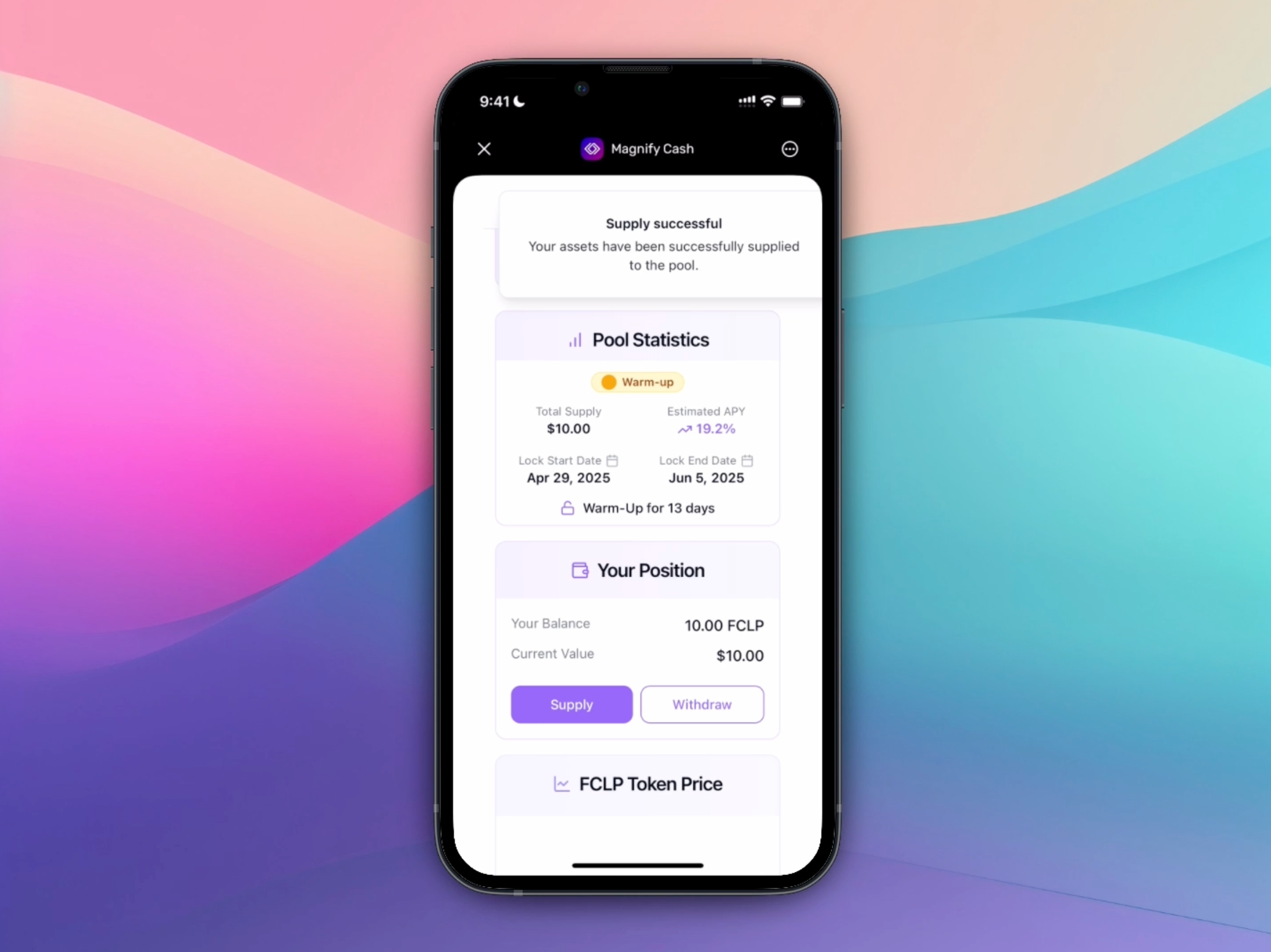

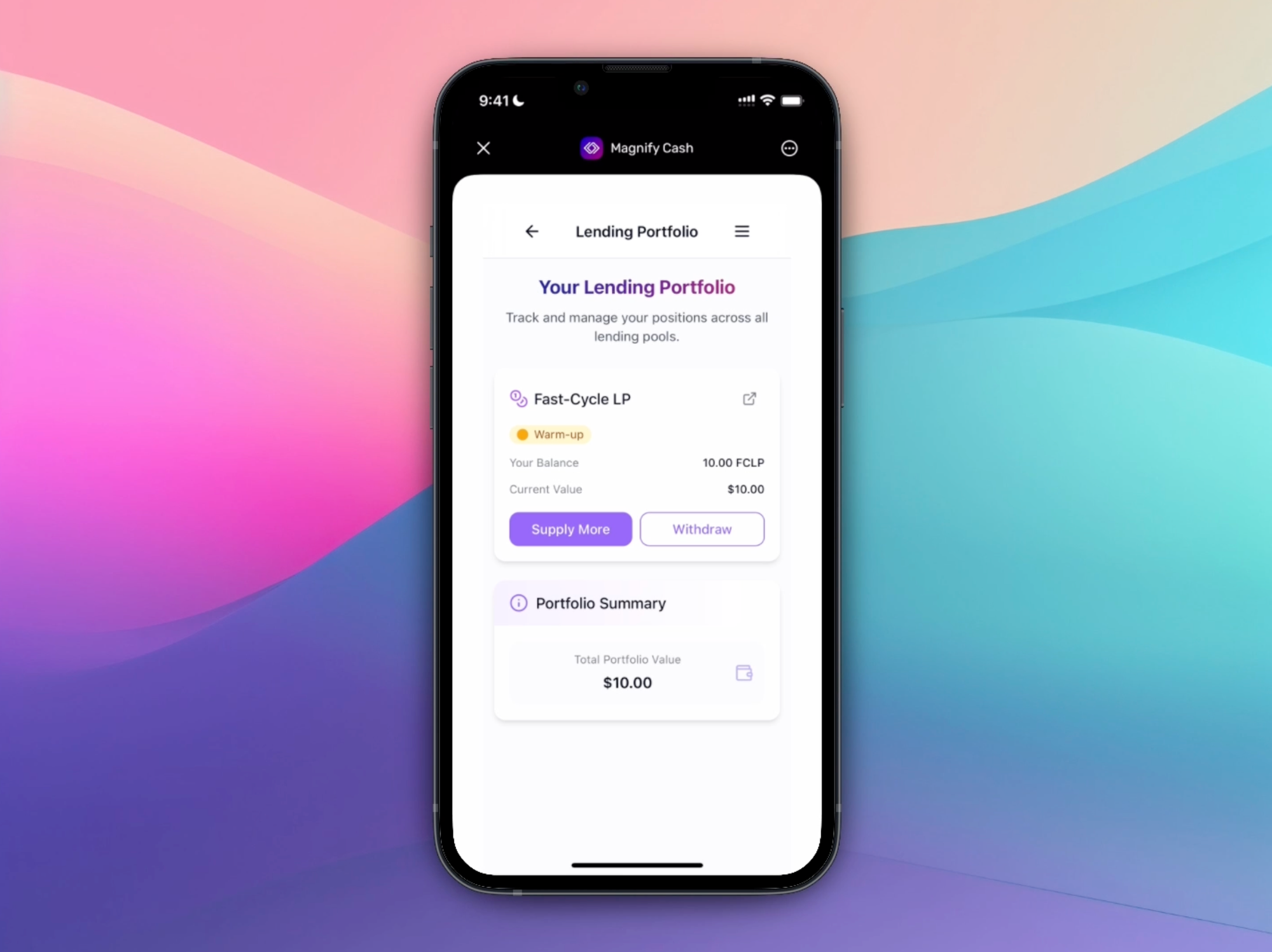

Step 7: See Supply Success

👉 After confirming, you will see a supply success message and your position in the pool.

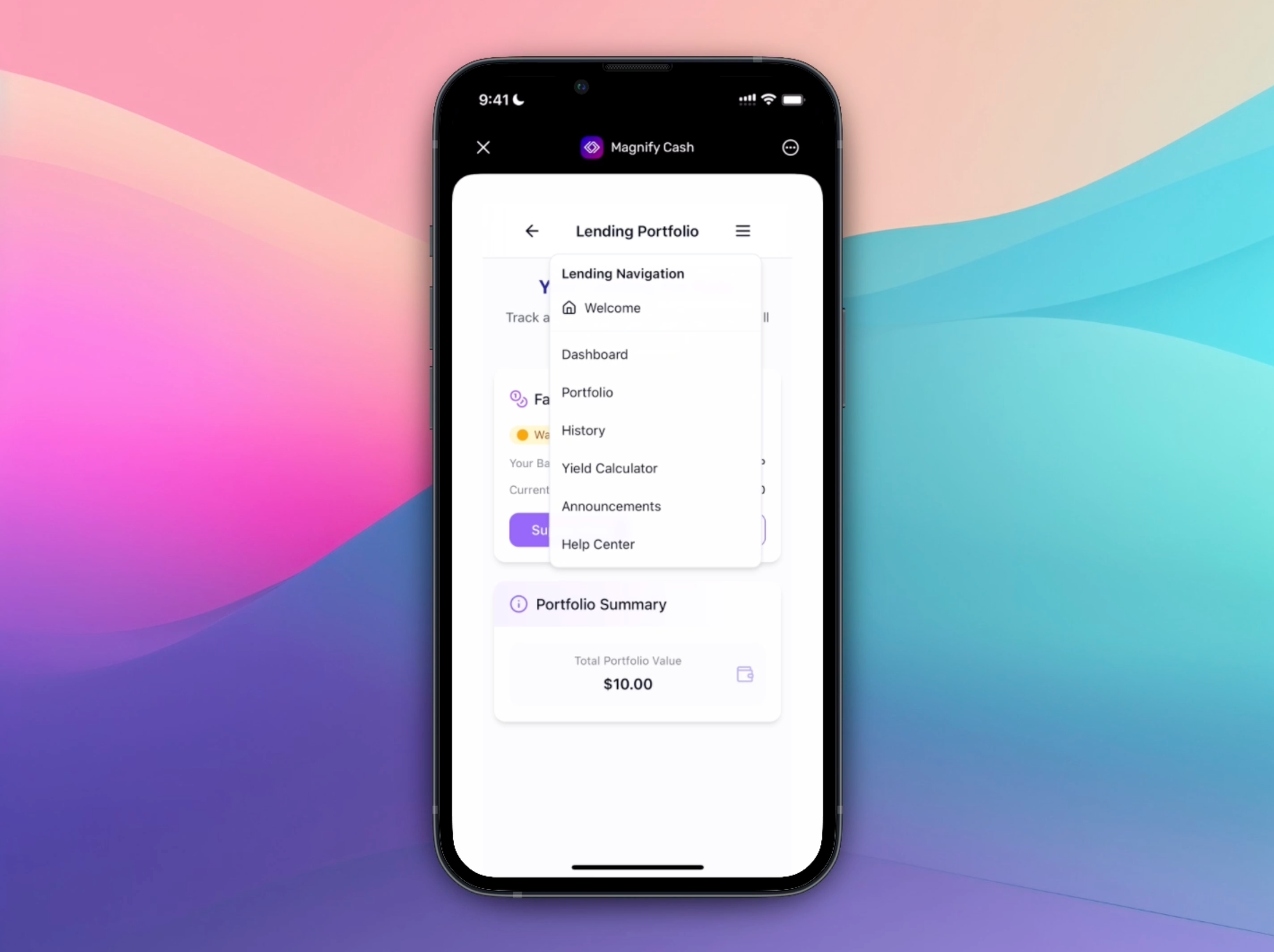

Step 8: Navigate the App

👉 Use the sidebar menu to view your dashboard, portfolio, history, and help center.

Step 9: View Your Lending Dashboard

👉 Track your supplied assets and see your active lending positions.

🔹 How Liquidity Pools Work

When you lend, you contribute USDC into a termed liquidity pool that operates through these phases:

| Phase | What Happens |

|---|---|

| Warm-Up | Deposits allowed, withdrawals allowed (small fee applies) |

| Active | Deposits allowed, borrowing opens, withdrawals locked |

| Cooldown | Borrowing paused, repayments collected |

| Withdrawal | LP tokens redeemable, lenders withdraw funds and yield |

You will receive LP tokens that automatically grow in value as loans are repaid.

🔹 Risk Management: How Lenders Are Protected

- Borrowers must pass World ID verification.

- Borrowers can only have one active loan across all pools.

- Borrowers who default are blocked from borrowing until they repay.

Magnify Cash is built for transparency, identity-based lending, and responsible growth.

🔹 Expanded Lender FAQ

What are LP tokens and how do they work?

They represent your share of the pool. LP tokens grow in value as loans are repaid.

What currencies can I use to lend?

Currently only USDC is supported.

Can I withdraw my funds before the pool ends?

- Yes during Warm-Up (small fee applies)

- No during Active or Cooldown

- Withdraw freely after the Withdrawal phase.

How is the LP token price calculated?

It reflects loan repayments and overall pool performance.

When and how do I receive my yield?

You redeem your LP tokens at the end of the pool term to receive your principal plus interest.

What happens during the Cooldown period?

Borrowing stops, repayments happen, and final pool performance is calculated.

Can I join a pool after it has started?

Yes, but only during the Active phase.

What happens if a pool doesn't attract enough borrowers?

Your principal is safe. Yield may be lower but funds are redeemable at maturity.

What happens if a borrower defaults?

They are blocked from borrowing until they repay their debt plus penalties.

How does World ID verification reduce risk?

It ensures every borrower is a unique, real human being, dramatically cutting fraud.

Can I use MetaMask instead of the World App?

Yes, but lending with MetaMask incurs small gas fees.

Do I need to pay gas fees?

No gas fees inside the World App. Small fees apply with external wallets.

How long is each pool term?

Terms typically range from 4 to 8 weeks.

Is there a minimum or maximum lending amount?

Minimum: around $10 USDC. Maximum: varies by vault.

Where can I get updates?

Follow our blog, Telegram, and Discord.

I have an issue. Where can I get support?

Inside the app support chat, Telegram, or Discord.

✨ Join the Movement

Whether you're a user, a supporter, or a staker, this is your moment to grow with us.

- 🌐 Explore the app: magnify.cash

- 📈 Track live metrics on Dune: Magnify World Stats Dashboard

- 📊 See TVL and rankings: Magnify Cash on DeFiLlama

- 📰 Read the latest updates: blog.magnify.cash

Stay Connected:

🏁 Ready to Start Lending?

Or open Magnify Cash inside the World App for a seamless, gasless experience.

Earn real yield. Support verified humans. Grow a decentralized credit network.